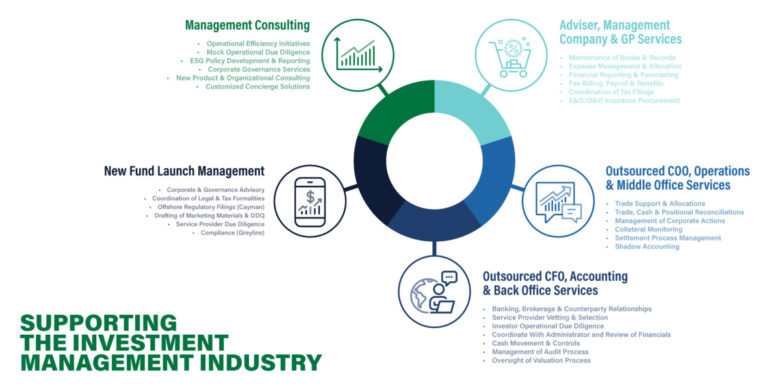

Outsourced CFO, Finance & Accounting Services

GCM’s dedicated team of finance and accounting professionals have extensive experience providing services to asset managers of all sizes and strategies – from new hedge fund launches to large, established private equity complexes and everything in between.

While the scope of services varies based on the needs of each individual client, the objective of GCM’s outsourced CFO model is straightforward: to assume responsibility for a manager’s back- and middle-office functions so it can focus on managing assets rather than non-revenue generating aspects of its business. Our premium, high-touch solutions are explicitly designed to satisfy even the most scrutinizing institutional allocators, as we seek to be value-added partners in our clients’ capital raising endeavors.

Outsourced COO, Operations & Trade Support Services

With a pedigree rooted in operations, back office, and fund administration, GCM’s seasoned group of professionals are well versed in setting up the infrastructure to sustain the full lifecycle of a trade. From equity to credit to derivatives and beyond, we can support a manager’s front office in carrying out any investment strategy by ensuring that trade operations flow seamlessly from front to back.

With a focus on effective and efficient workflows and processes, GCM performs a variety of different services uniquely designed to address the specific needs of each individual client. Whether an engagement calls for full, end-to-end operational outsourcing or simply an extra pair of hands, our clients can leverage GCM to provide best-in-class, yet cost-effective solutions.

- Trade Administration

- Trade Allocation

- Three-Way Reconciliations (Trade, Cash & Positions)

- Profit & Loss (P&L) Reporting

- Corporate Action Processing

- Collateral Monitoring

- Maintenance of Trade Files

- Securities Lending Review

- Risk Reporting & Monitoring

- Broker & Vendor Due Diligence

- Independent Price Sourcing

- Broker Utilization & Soft Dollar/CSA Monitoring

- Separately Managed Account (SMA)-Related Service

As with all of GCM’s service lines, our back- and middle-office support services are fully integrated with our core compliance vertical ensuring there is a unified and consistent front across both compliance and operations.

New Fund Launch Support Services

GCM’s new launch services are tailored to assist fund sponsors with bringing a new investment vehicle to market. Leveraging the collective experience of our team, which includes thousands of new launches, we can advise and execute on all phases of the structuring lifecycle, including:

- Prelaunch Conceptualization

- Formation-Related Services

- Operations and Workflows

- Service Provider and Vendor Engagement

- Establishing Brokerage and Banking Relationships

- Onshore/Offshore Regulatory Filings

Customized Concierge Services

As a complement to our core services, GCM also offers fully customized solutions geared toward an investment adviser’s needs or sensitivities. Whether it is acting as an additional layer in an allocator’s cash control process or serving as an independent bill-pay mechanism for a multi-family office in order to avoid custody, we thrive in solving the unsolvable through innovation and outside-the-box thinking.